Carbon: Beyond One Metric

We only have one metric for carbon – t CO₂ₑ – the simplicity of which may have been useful to carbon markets suppliers and investors in the past. But optimizing the right outcomes for the environment and yields for investors means valuing biodiversity and other co-benefits too.

Humanity must solve the climate and nature crisis together or solve neither, according to a report from 50 of the world’s leading scientists reporting to the Intergovernmental Panel on Climate Change (IPCC) and the Intergovernmental Panel on Biodiversity and Ecosystem Services (IPBES)¹. Climate science tells us it is imperative we keep global warming to well under 2 °C above pre-industrial temperatures and ideally to only 1.5 °C above. To avoid catastrophic climate change, we need to cut global emissions in half by 2030 and reach net zero by 2050². Meanwhile, the UN reports that at least one million species of plants and animals are now under threat³ and the current rate of species loss is tens to hundreds of times higher than the average over the last 10 million years⁴. The devastation of forests, peatlands, mangroves and other ecosystems around the planet over the past decades has decimated wildlife populations and released huge amounts of carbon dioxide exacerbating the climate crisis triggered by the burning of fossil fuels⁵.

Two-way street

We need to respond to this enormous challenge in the knowledge that carbon and nature are inextricably linked, and that measures too narrowly focused on climate mitigation or adaptation can have negative impacts on nature‘s fauna, flora and eco-services. For example, if emissions reduction projects involve planting bioenergy crops over large areas, or if carbon sequestration projects re-forest with monocultures, these may contribute to climate change mitigation but they can have severe consequences for biodiversity as well. Bear in mind also that relying on monoculture biomass for carbon mitigation can in any case be risky if using a species with high vulnerability to storms, fires or pests⁶.

Moreover, whilst climate change itself (as distinct from potentially misguided mitigation strategies) impacts natural habitats and biodiversity we should not forget it’s a two-way street. Through their effects on the nitrogen, carbon and water cycles, ecosystems and their biodiversity play a key role in the flow of greenhouse gases, as well as in supporting climate adaptation. Climate change and biodiversity loss are therefore closely interconnected and share common drivers through human activities. Understandably, the scientific community investigating climate change is distinct from that which studies biodiversity, and each has its own intergovernmental body – the IPCC and the IPBES. But this apparently reasonable functional separation carries the potential danger of insufficiently appreciating and responding to the connection between carbon and nature⁷.

Oversimple, underfunded

It’s a danger that is arguably reflected both by the state of climate crisis funding and by features of the carbon credit market (though as we shall see there are also grounds for optimism). In the latter, projects that remove, reduce, or avoid emissions generate carbon credits. Each credit represents one tonne of removed, reduced or avoided carbon dioxide or greenhouse gas equivalent. The metric used is simply CO₂ₑ and therefore currently has no capacity to express measurements for additional project co-benefits such as biodiversity, soil health, water and air quality, or community engagement and sustainable development. The likely bias therefore is to optimise for carbon in the absence of a more inclusive metric that can also somehow encapsulate one or more of the UN’s Sustainable Development Goals (SDGs).

This has also meant that there’s been significant uncertainty regarding how much a given carbon project may contribute to SDG co-benefits and has therefore led to criticisms of ‘SDG-washing’⁸ (as distinct from ‘greenwashing’ accusations that some projects have not satisfied the Kyoto Protocol principles of additionality, measurability and permanence).

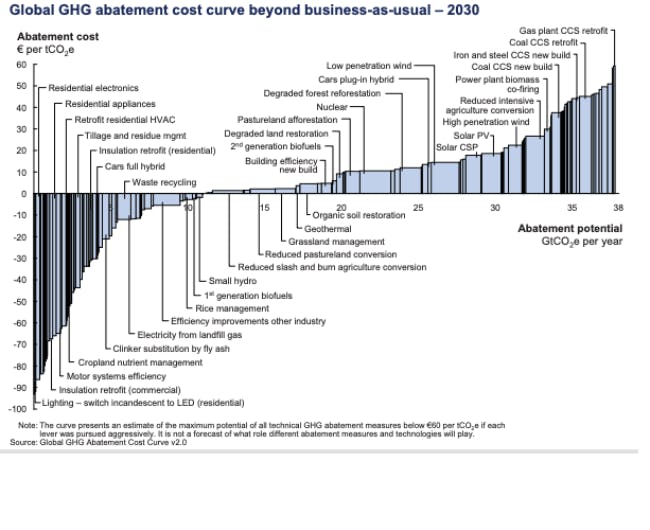

Turning to funding, it’s a depressing fact that only 1% of the finance devoted to the global climate crisis in 2020 was spent on nature restoration⁹. Yet a study published in Nature found that such “nature-based solutions” (NBS), when done well, were among the cheapest ways of absorbing and storing carbon dioxide from the atmosphere. The large surface area that leaves on trees provide is far more cost-effective and impactful than hardware engineered systems such as carbon capture and storage (CCS) that are expensive and lack scale (see Figure 1 GHG abatement cost curve below). And of course, the additional benefits of NBS are SDG co-benefits including the protection of wildlife and the restoration of crucial ecosystem services¹⁰.

Figure 1: Example carbon cost abatement curve (McKinsey, 2009)

But the bottom line is that NBS efforts have been severely undercapitalized despite the evidence that natural habitats provide major economic benefits in the form of avoided losses from climate change-related disasters as well as supporting ecosystems services worth an estimated $125 trillion annually. This lack of finance is widely recognized as one of the main barriers to the implementation and monitoring of NBS across the globe¹¹.

Some grounds for optimism

Given what we know about the interconnectivity of carbon and nature it is clear that too narrow a focus on carbon won’t yield the right outcomes for either ecosystems or carbon sequestration. Nature-based solutions can be most effective when planned for longevity and not simply designed for rapid carbon sequestration¹². Indeed, healthy, sustainable and biodiverse ecosystems have been demonstrated to sequester more carbon, with a higher resilience to ecological and human threats, than under-managed monoculture ecosystems¹³. When assessing carbon mitigation projects, the forecast in carbon potential needs to be considered in conjunction with the environmental co-benefits associated with the project and the risk associated with yield predictions. Parameters such as target biodiversity, habitat restoration, ground and canopy cover, soil resilience and threats from invasive species should be analyzed with high quality data metrics to inform project design.

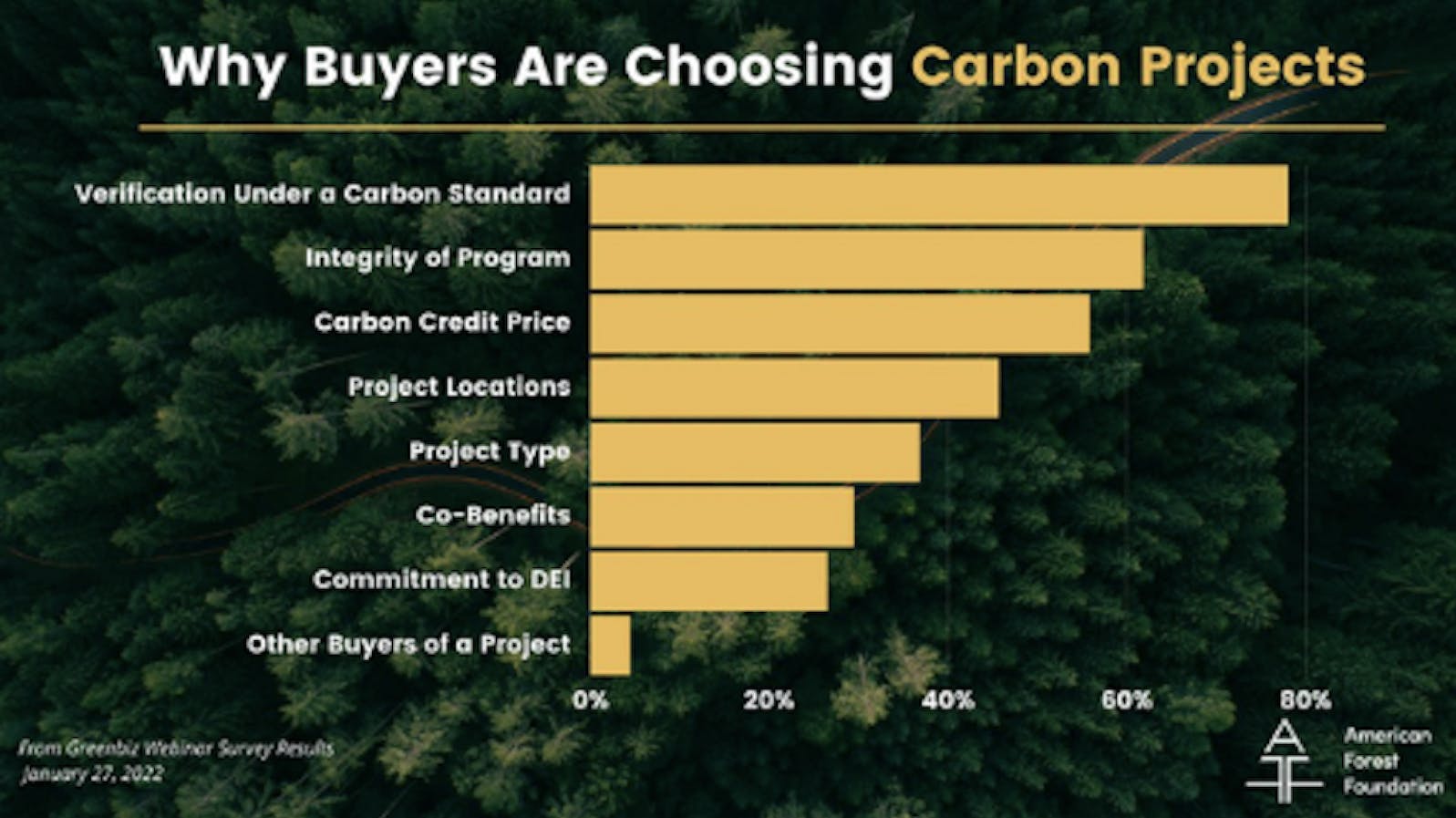

The good news is that there’s growing awareness and action in the carbon credit markets about the need to combine carbon mitigation with other co-benefits including biodiversity. An increasing number of projects developers are focusing beyond mitigation to offer additional value to companies and other carbon credit buyers¹⁴. Many of these are now looking at credits that not only offset their carbon footprint but demonstrate commitment to sustainability and SDG / ESG (environmental, social and governance) goals. In fact, a recent survey by the Forest Foundation found that nearly a third of respondents also evaluated projects based on their co-benefits (see Figure 2 below)¹⁵. Hopefully that percentage will continue to rise significantly over the next few years.

Figure 2: Why buyers are choosing carbon projects (American Forest Foundation, 2022)

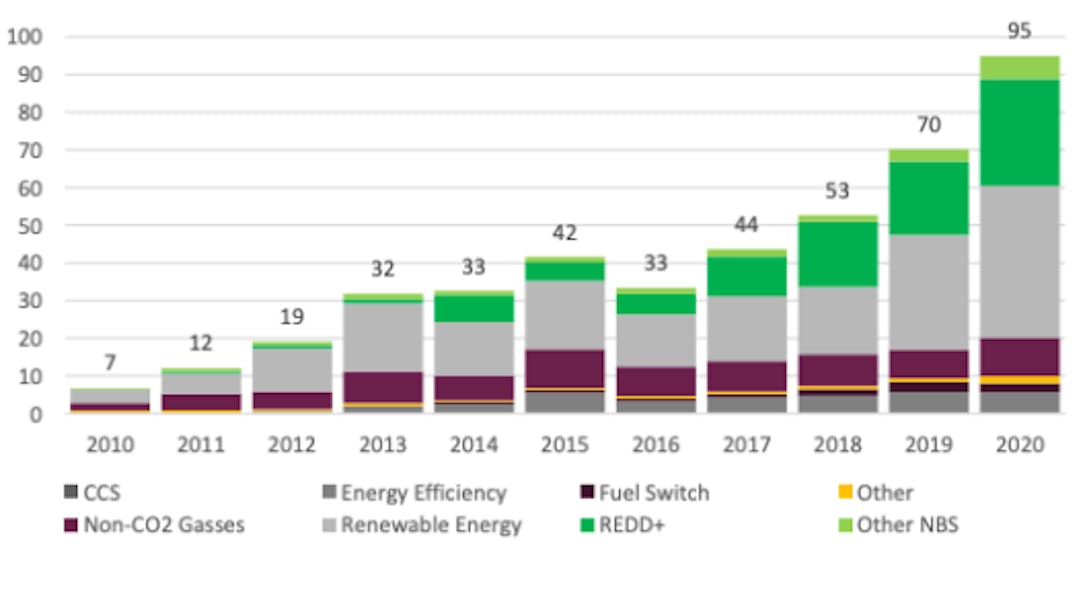

There is also an emerging trend towards a willingness to spend more per tonne for high quality offsets, driven by major corporations like payment service provider Stripe¹⁶. This is being reflected in the price of carbon credits in the voluntary carbon market (VCM). After years of credit surplus and consequent low carbon prices, the rise in VCM demand is driving prices higher, with credits from NBS projects seeing one of the biggest increases (see Figure 3 below). As of June 2022 different types of VCM credits are being traded for between $5 and $18 /tCO₂ₑ with high-quality nature-based credits commanding prices towards the top end¹⁷. Meanwhile, major certification bodies in the VCM like Verra and Gold Standard have been designing much-needed tools for the measurement of co-benefits. Verra has a SDG certification that quantifies co-benefits for carbon projects, and similarly Gold Standard has a SDG Impact Tool¹⁸.

A new metric?

In an ideal world there would also be a new carbon credit metric that reflects levels of SDG co-benefits. However, it is no easy task to formulate appropriate indicators and measurements for the effectiveness of, for example, nature-based interventions. Effectiveness is influenced by many interacting, context-specific factors that can change over time. And even if reasonable metrics can be created, the dynamic and complex nature of ecosystems make measuring and comparing the outcomes of interventions across scales quite challenging¹⁹.

Nevertheless, whether a simple standardized metric of NBS effectiveness can be devised that works across different scales, or whether instead we must create a variety of context-specific metrics it is important that the search for a solution continues. Such metrics could help increase our understanding of NBS effectiveness at the local level, support successful carbon mitigation, and reduce the chance of unintended consequences or maladaptation.

Good data required

In the absence for the time being of such metrics (and if they are developed) we still need reliable data that will guide us towards biodiverse carbon outcomes. In addition to global assessments, evaluations at regional, country and also local levels are needed²⁰. Direct, accurate assessments of, for example, the effects of deforestation on biodiversity furthers both our scientific understanding and our financial valuing of the link between carbon and nature. Data will be central to driving good decision-making required for landscape scale restoration, realizing carbon sequestration and achieving positive biodiversity and other co-benefits.

This is precisely where Dendra Systems can help. Dendra focuses on gathering, analyzing and presenting data across each of the pillars of carbon, biodiversity and ecosystem risks. Our data can aid in assessment of current and potential carbon and biodiversity co-benefit yields for investors and managers of agricultural land to power the right decision-making for carbon mitigation, ecosystems and financial markets alike.

In a world where corporations and governments are increasingly recognizing the value of ecosystem restoration on supply chains and resilience, wider environmental outcomes are as important as the amount of tradable carbon generated. To quote Professor Mark Maslin of University College London: “The science is very clear that climate change and biodiversity are inseparable. To stabilize climate change we need massive rewilding and reforestation.”²¹ Or in the words of certification agency Gold Standard: “We don’t even think about [additional impacts] as co-benefits. We think about them as core benefits.”²²

References

- Carrington (2021) https://www.theguardian.com/environment/2021/jun/10/climate-and-nature-crises-solve-both-or-solve-neither-say-experts

- UNEP (2021) https://www.unep.org/resources/emissions-gap-report-2021

- UN (2019) https://www.un.org/sustainabledevelopment/blog/2019/05/nature-decline-unprecedented-report

- UN (2022) https://www.un.org/press/en/2022/sgsm21291.doc.htm

- Carrington (2021)

- Pörtner et al (2021) https://zenodo.org/record/5031995#.YO50Ki2cZPs,%20https:%2F%2Fipbes.net%2Fsites%2Fdefault%2Ffiles%2F2021-06%2F20210609_workshop_report_embargo_3pm_CEST_10_june_0.pdf

- Pörtner et al (2021)

- Myers (2021) https://www.ecosystemmarketplace.com/articles/whats-in-a-carbon-credit-new-tools-help-quantify-the-sustainable-development-benefits-of-carbon-offset-projects/

- Harvey (2020) https://www.theguardian.com/environment/2020/oct/14/re-wild-to-mitigate-the-climate-crisis-urge-leading-scientists

- Harvey (2020)

- Seddon et al (2019) https://royalsocietypublishing.org/doi/10.1098/rstb.2019.0120

- Pörtner et al (2021)

- Hicks et al (2014) https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/331581/biodiversity-forests-ecosystem-services.pdf

- Idle (2021) https://sustainablebrands.com/read/walking-the-talk/not-all-carbon-credits-are-created-equal

- Goodman(2022) https://www.forestfoundation.org/why-we-do-it/family-forest-blog/a-snapshot-of-trends-among-carbon-buyers/?utm_source=newsletter&utm_medium=email&utm_term&utm_content=See%20the%20Full%20Results.&utm_campaign=FFCP

- Watson (2022) https://blog.toucan.earth/decarbonized-8/

- Haurie (2022) https://www.ipe.com/viewpoint-investing-in-the-future-through-the-voluntary-carbon-market/10060104.article

- Myers (2021)

- Seddon et al (2019)

- Siikamäki & Newbold (2012) https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3357890/

- Carrington (2021)

- Myers (2021)

- Mercury Glazing: mercuryglazing.co.uk