The Market for High-Quality Nature-Based Carbon Removal

Understanding Additionality, Measurability and Permanence

Dendra’s approach to our planet’s critical requirement for carbon mitigation addresses the three primary areas of

- Compliance

- Quality

- Management

Here we will be looking most closely at number 2, the foundations for quality in the carbon removal market.

Project quality, and the consequent quality of the carbon credits resulting from them, are vital for the credibility, durability and funding of the carbon market. If project quality is not ensured then trust in carbon credits can be compromised, demand and prices could fall, and much-needed project financing may not materialize. In this blog, we break down the concept of quality into its constituent parts of additionality, measurability and permanence, together with the co-benefits associated with a project. We also briefly touch on some of the improvements happening in the carbon market which will further support the attractiveness of nature-based projects.

Additionality, measurability, permanence

The Kyoto Protocol, adopted in 1997, committed industrialized countries and economies in transition to limiting and reducing greenhouse gas emissions. It also established the concept of additionality, meaning that carbon offset projects and their associated credits should demonstrate real, measurable and long term benefits in reducing or preventing carbon emissions.These are typically referred to as additionality, measurability and permanence.

For a project to be additional not only must emissions reduction, removal or avoidance be proven to take place (i.e. it’s real), but the outcomes must be over and above ‘business as usual’ i.e without carbon credit financing the project and consequent mitigation would not have happened.

Measurability encompasses both the accurate quantification of a project’s emissions mitigation and also the establishment of a credible emissions baseline under a business as usual scenario.

Permanence means that the emissions mitigations are non-reversible, for example, that newly reforested land will not subsequently be cleared in years to come. Clearly, some projects carry a reversibility risk e.g. from forest fires. Such risks can be addressed by a combination of best efforts safeguarding; conservative carbon credit issuance (secured by a ‘buffer’ pool); and by building in a mechanism of replacement and compensation for mitigations suffering a reversal.

In the past, carbon projects have received criticism in relation to one, two or all three of these offset quality requirements. Accusations of greenwashing have questioned whether projects are genuinely additional or would in fact have happened anyway; whether mitigations claims have been inflated; and whether they are credibly permanent. This has in turn meant that the perceived quality risk associated with these credits has often been high and that the credits have therefore carried a steep discount. Even if the average project cost of these credits is low, if due to their associated risk the price of the credits is also low, then the scale of investment in these projects will be diminished. In this situation, seemingly expensive negative emissions technology offset projects (such as direct air carbon capture and storage) could be a preferred investment option if they score well across additionality, measurability and permanence. However, this would be a sub-optimal outcome given 1) the huge abatement potential of nature-based solutions (NBS) projects right now, 2) the relative immaturity of current CCS deployment and 3) the cost of CCS projects which are typically more expensive than NBS. The message is clear: rigorous additionality, measurability and permanence standards for NBS projects are essential.

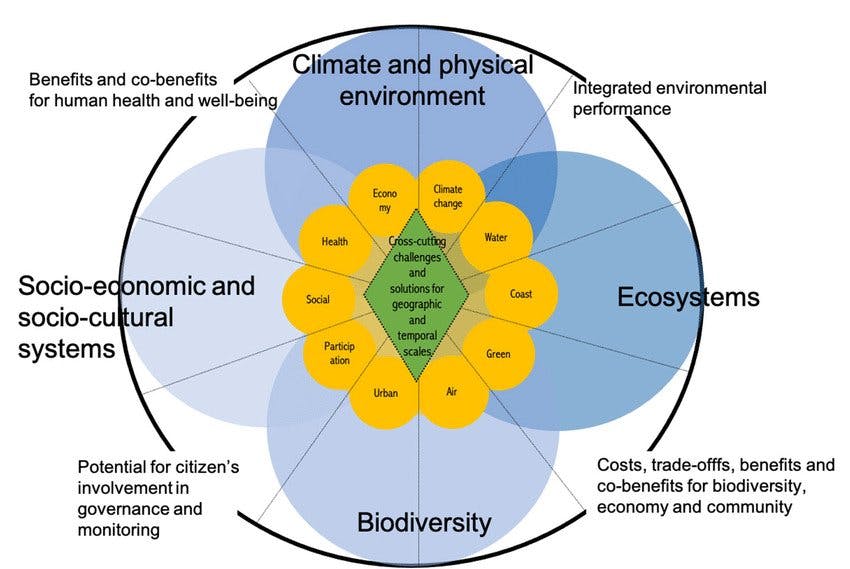

Project co-benefits

Assuming that NBS projects can satisfy the additionality, measurability and permanence imperatives, they could then be well-positioned to realise additional gains associated with their so-called ‘co-benefits’. Briefly, co-benefits are those non-carbon benefits that accrue to the natural environment and local communities. The list of potential co-benefit categories is long, and often includes:

- Biodiversity

- Soil health

- Water quality

- Flood abatement

- Air pollution mitigation

- Local community engagement

- Land productivity and sustainable development

- Health

Price premiums for quality

NBS projects, if done well, clearly have significant potential to generate co-benefits across many of these variables. And the data are increasingly pointing to co-benefits realizing significant carbon credit price premiums. S&P Global Platts, a provider of energy & commodities information, has created a carbon credit price tracker for high-quality nature-based solutions. In November 2021, the Platts CNC price assessment reflected a 50% premium to similar nature-based credits eligible under the CORSIA offset program which includes a broader range of credit types.

The 5 drivers of quality, and therefore price premium, for carbon credits as identified in the Australian Financial Review (King, 2021) are:

- Scheme it’s registered under (i.e. how rigorous the verification and reporting standards are)

- Location of the project generating the carbon credits

- Project type (eg human-induced regeneration (HIR) vs Biodiverse tree planting)

- Co-benefits as discussed above

- Age of the project (more recent ‘vintages’ are preferred)

Market improvements

The establishment of price assessments, and the associated price transparency they bring, is an important addition to the continued development of the carbon market, particularly for nature-based solutions. In years gone by, the variability of nature-based carbon offset projects, with all of their associated and non-fungible co-benefits, translated into a lack of project and price transparency. This in turn dampened demand, credit price, and ultimately the amount of finance available for carbon mitigation projects. Improved depth of credit supply, continued creation and refinements to credit methodologies, and ongoing efforts to improve and standardize monitoring, reporting and verification will all continue to help de-risk nature-based projects. This will support returns from, and investment in, these projects. Additionally, these positive developments will be substantially helped by the Integrity Council for Voluntary Carbon Markets which aims to establish global benchmarks for project integrity and carbon credit quality.

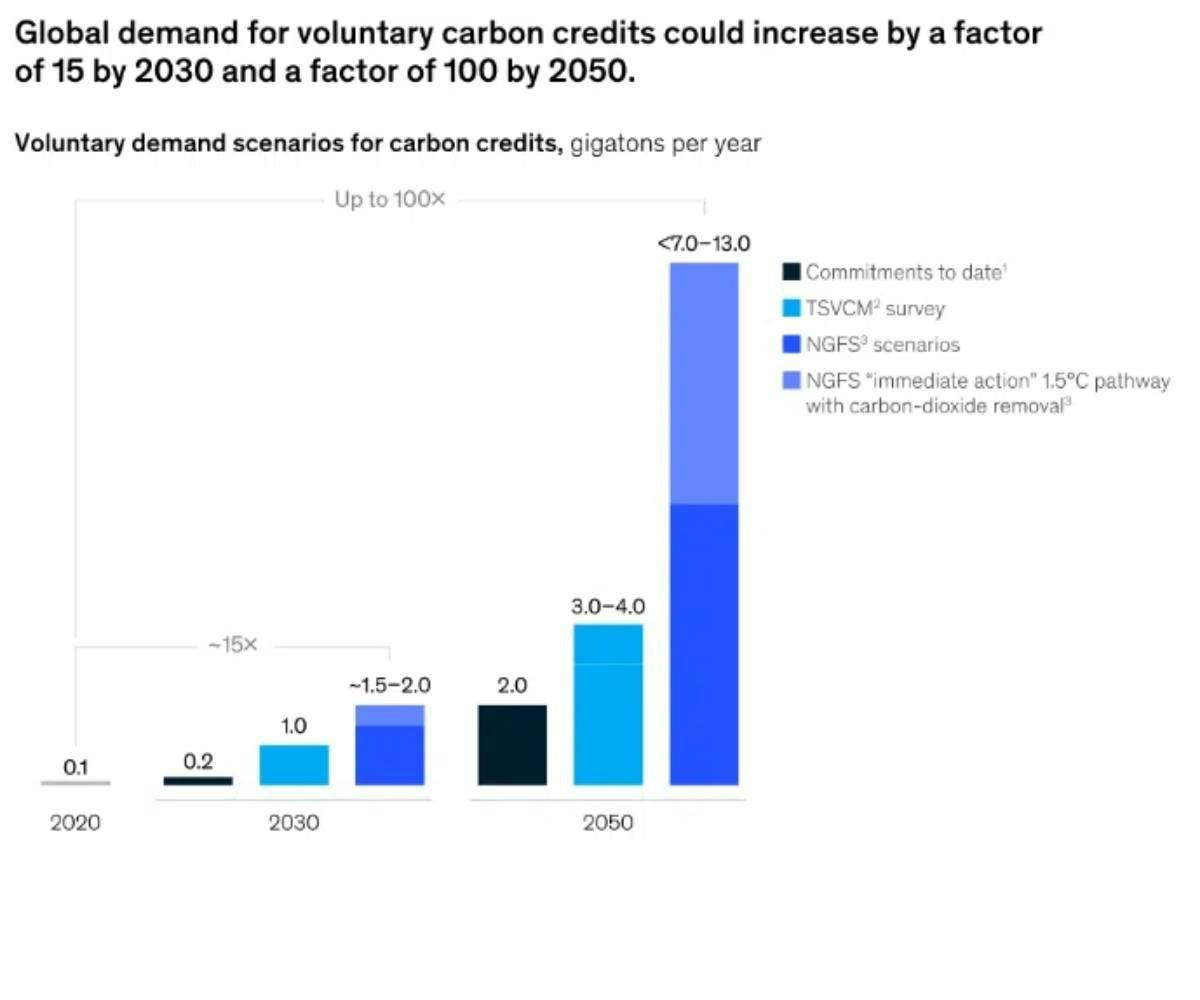

The road ahead: High-quality carbon

In terms of market capacity we are starting from a very low base. 2021 was the first year to breach the US$1bn carbon credit mark in voluntary markets, from which much of the growth in carbon sequestration-related supply is likely to come. In order to realize the full carbon mitigation potential of nature-based solutions, a focus on improving both the market infrastructure as well as the quality of projects is key. For those aspiring to develop quality projects, that means demonstrating additionality, measurability and permanence, as well as highlighting their projects’ co-benefits. The extra effort to do so is increasingly being rewarded.