Carbon: Measuring and Valuing Biodiversity Co-Benefits (Part 2)

Part 2: Making Progress

In a previous article, we looked at the need for a standardized metric for valuing biodiversity alongside CO₂ mitigation and the challenges involved. Here, we consider what progress has been made so far.

Last October, the ‘Kunming Declaration’ on biodiversity was agreed by more than 100 countries at the Convention on Biological Diversity (CBD) in Kunming, China. The declaration commits countries to supporting a global framework that aims to put biodiversity on a path to recovery by 2030 at the latest. Meanwhile at the 2021 United Nations Climate Change Conference in Glasgow, 141 countries signed a declaration to work collectively to halt and reverse forest loss and land degradation by 2030¹.

In a previous blog, we looked at the vital necessity to confront global warming and ecosystem loss simultaneously, and to have a standardized biodiversity unit of measurement that can help further that objective via the financial markets. As we saw, devising such a measurement is complicated because of the heterogeneity and ‘hyper-locality’ of ecosystems. Nevertheless, the activity around formulating standardized metrics is gathering momentum. Primarily, this is due to the sheer urgency of the problem but it’s also been helped by developments in biodiversity data. As we have seen, the multi-dimensional nature of biodiversity presents a major challenge but the quality and availability of data for many different dimensions of biodiversity have improved in recent years. This has made it possible to develop higher-quality, higher-resolution maps of biodiversity and carbon stocks at global scale².

A Growing Conversation

The UK’s Royal Society, for example, published a paper in 2020 that used integrated high-resolution satellite maps of carbon stocks and biodiversity to identify areas of potential co-benefits for climate change mitigation and biodiversity conservation. Significantly, the paper offered a methodology for formulating integrated biodiversity indicators that incorporate local species diversity and ecosystem intactness, as well as regional habitat conditions. The authors suggest this represents a ‘proof of concept’ that could be used by scientists, project managers, and policy-makers to better monitor and understand the status of an ecosystem’s biodiversity. It could also help identify areas where conservation action could make substantial contributions to both climate mitigation and biodiversity goals³.

Another paper published by the International Institute for Environment and Development (IIED), also in 2020, focused on the potential for tradable bio-credits. Unlike biodiversity offsets these would not offset or compensate for actions with negative impacts on biodiversity elsewhere. Instead, they would be used to fund investments in biodiversity conservation with a net gain from a pre-existing baseline. Nevertheless, the paper acknowledged that an important component would be the ability to generate a unit of measurement or metric and that such biodiversity accounting was only nascent. It did, however, suggest that the UN-adopted System of Environmental Economic Accounting (SEEA) had made some progress in measuring, assessing and accounting for biodiversity. Interestingly from our perspective at Dendra Systems, this paper also highlighted the importance of the use of and resolution capability of satellite remote sensing for capturing and monitoring ecosystem conditions⁴.

Similarly, the 2019 IPBES Global Assessment Report on Biodiversity and Ecosystem Services also highlighted data, inventories, and monitoring as key information needs for biodiversity protection. The report was the first global assessment in almost 15 years since the release of the Millennium Ecosystem Assessment (see earlier) of the status and trends of the natural world, their causes, and the actions that can still be taken. It also identified the need to improve the mapping and ‘stock-taking’ of nature (e.g. biodiversity inventories) and improve “the assessment of the multiple values of nature, including the valuation of natural capital by both private and public entities”⁵.

Task Force on Nature Reporting

Whilst the measurement of natural capital and ecosystem services has clearly made progress, the most significant development is the establishment of the Taskforce on Nature-Related Financial Disclosures (TNFD), a global initiative launched in June 2021 which aims to facilitate financial institutions and companies in forming a complete picture of their environmental impacts and action points. An initial assessment undertaken by the TNFD found that there are more than 3,000 different nature-related metrics in use already today by standards bodies, policy making and regulatory bodies and in major scientific reference reports⁶.

The TNFD is gaining in prominence in the global financial sector alongside the Task Force on Climate-Related Financial Disclosures (TCFD). Currently, the TNFD is ‘beta-testing’ its framework of nature-related obligations for disclosure and management. But in September 2023 the landscape for financial companies who have signed up will change significantly. At that point, TNFD obligations begin in earnest. This will push financial companies towards being “nature positive”, requiring them to invest more into nature to offset the impact on biodiversity loss or land clearance from activities within their lending portfolios. As well as de-risking existing investments and assets, the TNFD will also help banks create new “green” lending products and activate new markets, including a push towards trade credits attached to nature. The tide is clearly turning such that the Asia-Pacific climate and sustainability leader Deloitte is predicting an emerging market based around natural capital assets which could include co-benefits attached to carbon credits⁷.

Metrics in the Carbon Markets

Turning specifically to the carbon markets, a 2016 report, for example, analysed eight different standards (including the Gold Standard and the Rainforest Standard) that were applied to compliance market REDD+ projects. The standards were scored for carbon mitigation integrity and also for co-benefits including biodiversity conservation and offer a useful assessment of the standards (at that time). However, no attempt was made to establish actual metrics that could be used for creating monetized carbon market units⁸.

Nevertheless, momentum has been gathering in the VCM – albeit imperfectly – with carbon project financiers and developers engaging with the problem along with the certification agencies. For example, through their EcoAustralia product, financier-developer, South Pole are now selling carbon credits combined with Australian Biodiversity Units (ABUs) (devised by South Pole but government-accredited). The standardized unit has no specific biodiversity metrics associated with it, just a measurement of area – each unit represents 1.5 m2 of protected land “delivering biodiversity outcomes for Australian flora and fauna species”. Bypassing an actual measurement of biodiversity value in this manner is not the way the markets should evolve long-term. Nevertheless, it’s another indication of the underlying market need for a standardized consensus metric to value biodiversity.

Meanwhile, the certification agencies continue to refine their biodiversity standards and impose rigorous assessments from the early stages of project design and development through to implementation and later (see, for example, Verra’s Climate, Community & Biodiversity (CCB) Standards and its Sustainable Development Verified Impact Standard (SD VISta), and also Gold Standards ‘Global Goals’). Moreover, it is highly likely that some of these agencies are looking beyond certified standards and are currently in the process of developing specific standardized metrics .

In Australia, the Accounting for Nature framework (AfN) has created a common unit of measure that describes the condition of any environmental asset (native vegetation, soil, rivers, fauna, estuaries, etc), at any scale with an index score between 0 and 100. This measure of condition can be used to understand whether actions are improving or degrading natural capital. The AfN framework combines the science of reference condition benchmarking with scientifically accredited sampling methods. The result is the ‘Econd’ (environmental condition index), a common unit of measure that enables scientific data to be placed into an accounting framework to create a crucial bridge between economics and the environment⁹. An Econd does not imply a monetary value as such but AfN metrics are already being used with carbon credits. For example, payments made under the Queensland Land Restoration Fund include an embedded carbon credit plus a payment for a (mostly) AfN-measured biodiversity co-benefit.

Imagine then if Australian businesses decided they only wanted to purchase carbon credits such as ACCUs which also come with a highly credible biodiversity co-benefit (see Fig. 3 below). If that happened, landholders would be rewarded for not only the carbon they sequester but also for the biodiversity values they create along the way. For example, carbon can be sequestered through restoration of original native vegetation. By planting a mix of species resembling the original vegetation and re-creating important habitat for native species, additional biodiversity values are created. In this way, biodiversity certificates or units can be created and then ‘stapled’ to a ‘plain vanilla’ carbon ACCU. There could then be markets in carbon credits co-existing with biodiversity markets¹⁰. As Tanya Plibersek, Australia’s Minister for Environment and Water, has stated: if biodiversity improvements can be described and measured, and if landholders efforts can be formally credited, then markets can put a price on that, businesses can invest in the credits, and landholders can then profit from their services to nature¹¹. This, of course applies not only to one specific country but is potentially applicable all over the world.

Technology: A Key Component

Alongside progress in market mechanisms, from new policy-making and from increasing demand from businesses and other organizations, technology will be at the forefront of the development and implementation of standardize biodiversity metrics. Web 3 and blockchain may play a part, as will (and already do) precision satellite imagery, remote sensing, drone use, environmental DNA, and advanced machine learning. Capturing, analysing, and monitoring biodiversity at different scales is complex and requires both innovative technological tools and human ingenuity. Multi-disciplinary teams will need to collaborate in sometimes new and unfamiliar ways¹².

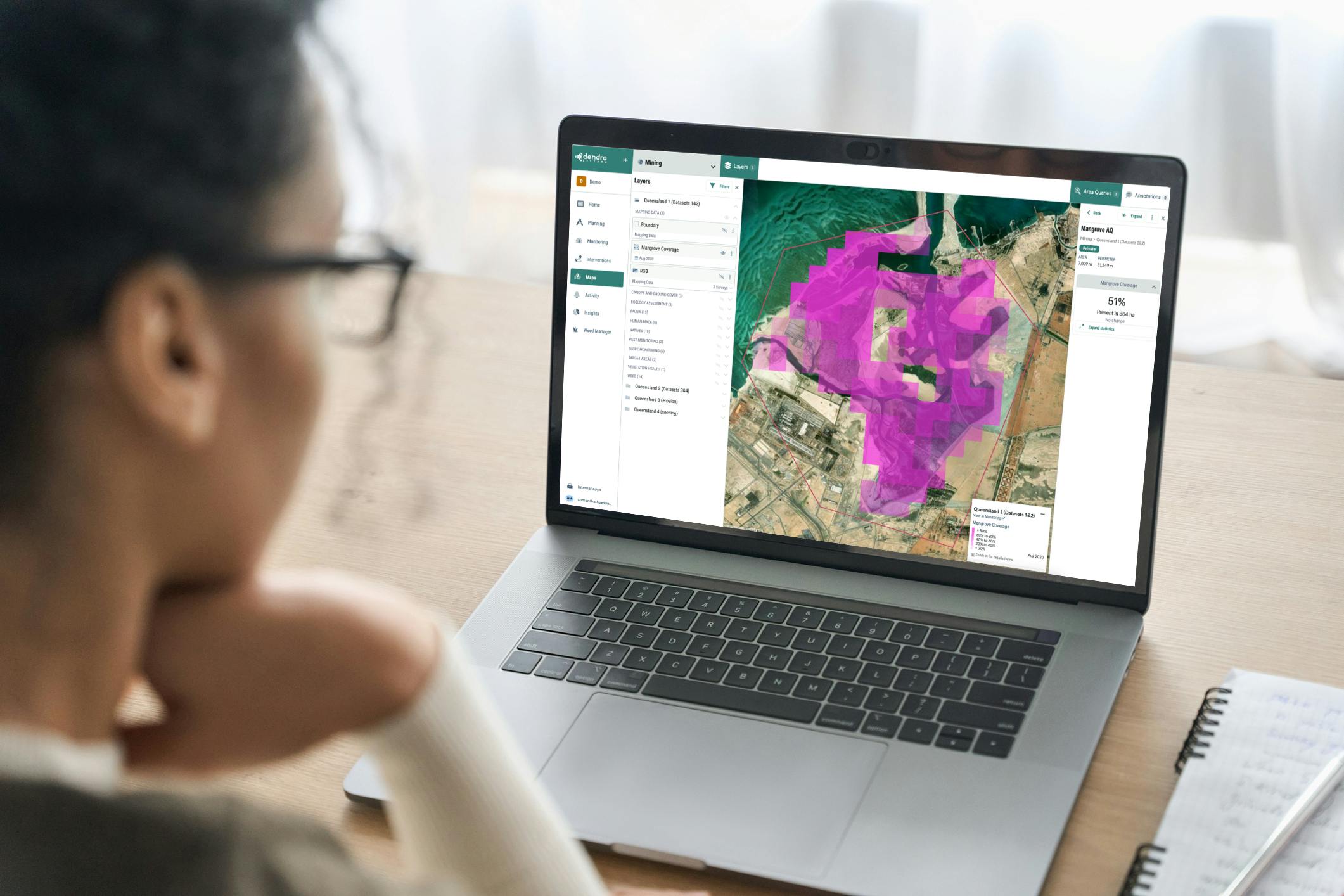

Dendra Systems’ expertise makes us well-placed to be part of that multi-disciplinary effort. We’re a global environmental tech company delivering AI solutions to the nature-based market. We specialize in remote sensing approaches to nature-based carbon and in particular biodiversity co-benefit quantification to enable monetization and trade in biodiversity co-benefits. As we have seen, the carbon markets are paying premiums for co-benefits. This is important because it provides the market with information about what a stand-alone biodiversity co-benefit unit might be worth and hence provides data as to what type of metrics can be measured and monitored.

The tight margins in the carbon market (and likely in biodiversity co-benefits markets too) will drive the need for cost-effective measurement and monitoring. Biodiversity assessment can be extremely expensive. Approaches such as the biodiversity assessment method (BAM) in NSW Australia, which focuses on field-based assessment, can cost as much as $50,000 – $100,000 per site. The evolving biodiversity co-benefits market will need new metrics which can be measured at lower cost but which are sufficiently rigorous to provide confidence in the market.

Meanwhile, Dendra Systems is involved in the TNFD Data Catalyst project. Dendra will play an important role in providing land-based metrics for TNFD reporting and disclosures required by financial entities and corporations whose activities impact on nature. These metrics will be similar to, if not the same as, for biodiversity co-benefits in the carbon markets. And as ever, we will continue exploring further innovations to provide metrics that are readily available and cost-effective – metrics that will play a key role in helping to preserve the biodiversity on which humanity depends.

References

- Environmental Finance (2021)

- Soto-Navarro et al (2020)

- Soto-Navarro et al (2020)

- Porras & Steele (2020) IIED Making the market work for nature https://pubs.iied.org/sites/default/files/pdfs/migrate/16664IIED.pdf

- IPBES (2019)

- TNFD (2022) https://framework.tnfd.global/tnfds-draft-approach-to-metrics-and-targets/

- https://www.afr.com/companies/financial-services/banks-preparing-new-disclosures-to-show-impact-of-lending-on-nature-20220814-p5b9nv

- Schmidt & Gerber A comparison of carbon market standards for REDD+ projects https://www.atmosfair.de/wp-content/uploads/17247.pdf

- Wentworth Group of Concerned Scientists (2016)

- Henry (2022)

- Plibersek (2022) National Biodiversity Conference address https://minister.dcceew.gov.au/plibersek/speeches-and-transcripts/national-biodiversity-conference-address-minister-environment-and-water-tanya-plibersek

- Rose (2022)