Carbon: Built to Last? Reversibility and the Importance of Permanence

For high-quality NbS carbon projects, permanence, or additionality over the long term, requires ongoing effective project management. Effective management requires reliable, detailed data and actionable insights to inform the right interventions at the right time coupled with the right teams of people to get the work done.

In previous articles, we’ve looked at the concepts of additionality and measurability, originally key features of the 1997 Kyoto Protocol and later the 2015 Paris Agreement, and an intrinsic part of any baseline-and-credit carbon market. Here, we consider ‘permanence’ – another critical but challenging component of the carbon markets, especially for nature-based solutions. The issue of longevity in carbon projects can be thought of as a question of additionality (and by extension, measurability) but one that’s ongoing over time.

The different greenhouse gases that cause global warming and resulting climate change remain in the Earth’s atmosphere over very different timespans. Methane and nitrous oxide will last between approximately a decade and a century. Carbon tetrafluoride has a lifetime of some 50,000 years. Over time, natural processes will remove these gases from the atmosphere but the exact longevity of carbon dioxide (CO₂), the gas contributing most to global warming, is also the most difficult to pin down¹. Several different processes remove and store CO₂ from the air. These include dissolution into the oceans, sequestration by trees and other biomass, and very long-term geological actions like chemical weathering. How long CO₂ takes to sequester, and how long it’s stored for, varies by process but the basic fact is that it can remain in the atmosphere for a long time – if forced to simplify, we’re talking several centuries to a few thousand years² during which time it can continue to affect the climate.

It’s clearly vital therefore that we not only take urgent action to mitigate CO₂ emissions now but that we try to ensure that our efforts are as long-term as possible. That holds whether the mitigation effort uses:

1) A removal process which pulls CO₂ out of the atmosphere (e.g. direct air capture technology or nature-based solutions (NbS) such as afforestation and reforestation); or

2) A reduction/avoidance process that limits or prevents CO₂ from entering the atmosphere in the first place (e.g. renewables and carbon capture and storage (CCS), or NbS such as avoided deforestation).

Risk of Reversal

This has relevance to baseline and credit carbon markets (and those cap and trade systems that allow offsetting credits alongside emissions permits). When a carbon project generates credits, these will be used by an ultimate end buyer to offset a carbon footprint. As far as the buyer is concerned, it’s a done deal, and the footprint has been neutralised (i.e. balanced) by a corresponding mitigation elsewhere. But what if the mitigation doesn’t last? If a project subsequently fails and the emissions removal, reduction or avoidance suffers a so-called “reversal”, then the carbon credit is no longer underpinned by the offsetting function it’s supposed to represent³.

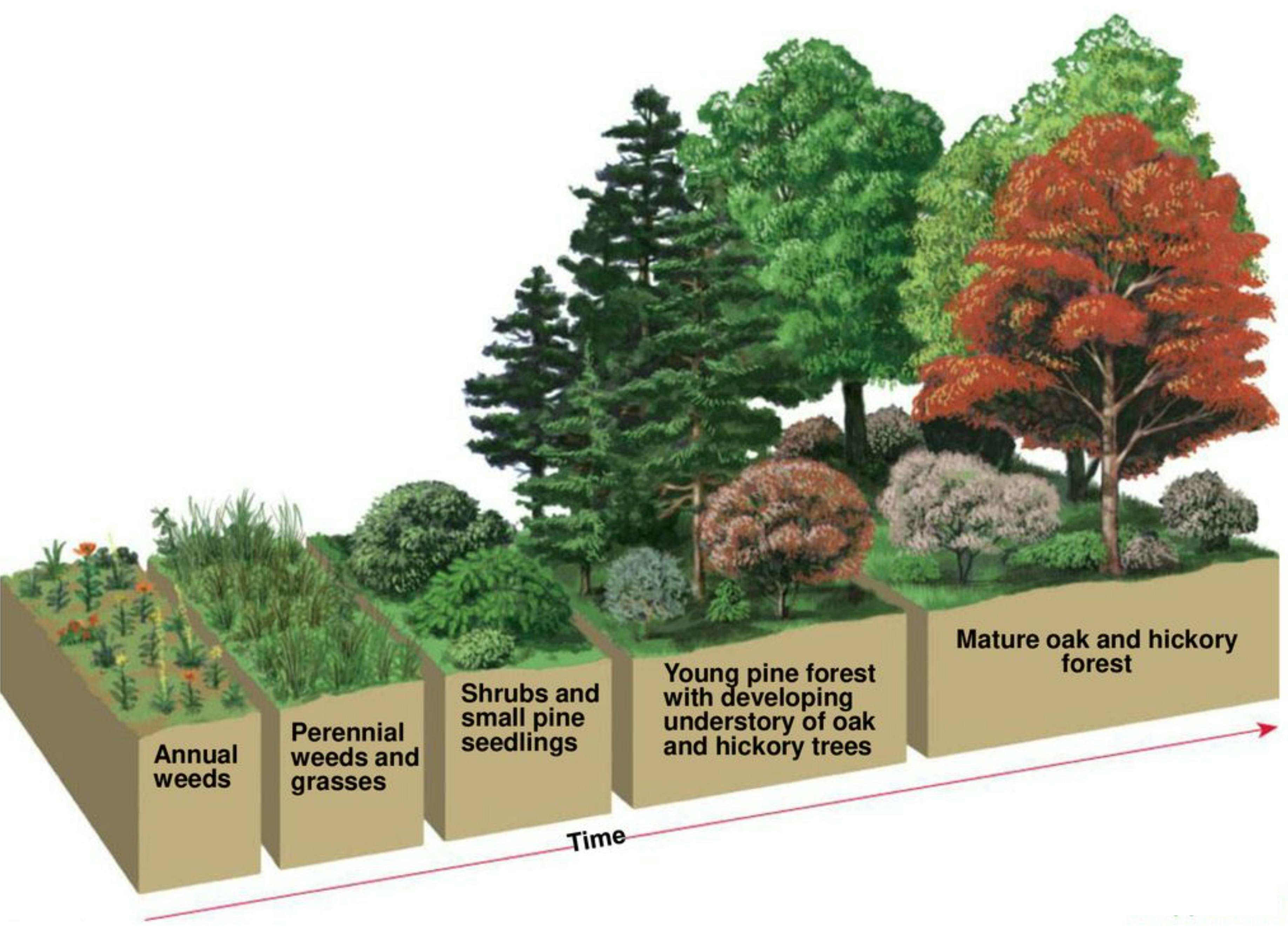

The Kyoto Protocol, and subsequently the Paris Agreement, stipulated that carbon mitigation projects should have “… long term benefits related to climate change”⁴. This requirement is also a key component of projects in other carbon markets, both compliance and voluntary. Interestingly, “long term” was not further defined though it’s often considered to be a 100-year time horizon⁵. In addition, the requirement is typically referred to as ‘permanence’ which is something of a misnomer. No reversal risk can be insured against in perpetuity – a hydroelectric scheme could run out of water, rare earth metals vital for wind power might be depleted, and not even geological CO₂ storage can be absolutely guaranteed to last forever. Nevertheless, over e.g. a 100-year time span, such ‘reversals’ are very unlikely for many types of carbon projects. As we shall see, NbS projects do carry reversal risks, but when done well, using biodiverse polycultures rather than monocultures, they have substantial capacities for resilience, regeneration, and longevity.

NbS is Valuable

Despite the potential for reversal, nature-based strategies which leverage natural carbon sequestration are an essential part of climate change mitigation, given the urgent timescale of global warming and widespread ecosystem degradation. The Intergovernmental Panel on Climate Change (IPCC) reports that such NbS strategies, which include afforestation, reforestation, improved forest management, and avoided forest conversion, have the potential to achieve one-quarter to one-third of the mitigation required to meet climate stabilization targets by 2030⁶. In fact, NbS will remain a particularly important strategy for CO₂ mitigation over the next 100 years until the decarbonisation of all industries can be achieved and whilst we are still dealing with historical emissions.

Moreover, NbS projects, again when done well, are among the cheapest ways of absorbing and storing carbon dioxide from the atmosphere⁷. Possible technological solutions, such as direct air capture of CO₂ followed by injection into rock or soil, are still immature and are currently very expensive, costing between US$100 and $300 per ton of carbon removed. Planting a tree, by contrast, can cost US$15 to $20 per ton removed⁸. In addition, some scientists argue that technological solutions may not actually work on the vast scale that’s needed⁹.

But NbS can also be Vulnerable

While NbS is a critical part of the solution, it’s important to manage the risks. Measurement, monitoring and verification across the lifetime of a project are vital to ensuring actual drawdown is achieved. In the carbon markets, this has sometimes led to questions and criticisms about potential risks to permanence¹⁰. Those risks can come at different points in the lifetime of a project and, most importantly, include inadequate management and fire hazard.

The Issue of Fire

One-third of global forest loss between 2001 and 2019 has been due to fires¹¹. Whilst globally, the area burnt by wildfires has declined over the past decades by up to 25%, the regions experiencing fire are shifting¹². Fire can be important for maintaining ecological processes and vegetation in some ecosystems e.g. savannahs and grasslands, but fire is now occurring more frequently in ecosystems that should rarely experience large fires (e.g. tropical forests). For example, the Amazon – the world’s largest terrestrial carbon sink – has seen a significant rise in the number of fires across Brazil, Bolivia and Peru due to human-driven deforestation, logging and exploitation¹³. After a fire, forests can be more vulnerable to both environmental threats such as invasive species, and to human threats such as so-called “salvage logging” (where trees that have been damaged but might well survive are still logged). If the situation in the Amazon continues, then the interaction of deforestation, widespread use of fire for clearing, and of climate change itself could push a normally wet tropical ecosystem towards an ecological tipping point, and to an eventual future as a degraded low-carbon savannah system¹⁴.

Engaging Local Communities

Moreover, in considering the issue of permanence, it is essential that the situation and interests of landowners and local people are aligned with an NbS project for the long term. Ideally, there should be community engagement and co-benefits (e.g. health and education programs, and agro-forestry training) so that local people are supportive and deter illegal logging. Property rights and land tenure must be clear¹⁵. Longevity must be ensured so that a change of ownership does not jeopardise project success.

Managing for the Long Haul

In both the short and longer term, adequate finance and good management are key. If projects are underfunded or poorly managed, then no matter how well the initial seeding or planting exercise is done, it will likely not succeed. For example, planting a tree in the tropics and then simply neglecting it makes its chance of survival extremely low – in most cases less than 5% – since it will be outcompeted by fast-growing undergrowth¹⁶. Good management involves active after-care – one estimate puts the initial planting at only 2% of the overall work needed to raise a tree to maturity. It also requires monitoring and verification to 1) assess survival and growth rates, and 2) establish useful data points from which to draw if attempting to either replicate the project or adjust methodologies or selection of tree species¹⁷.

The risk is that cost expenditure and management focus (and also public/political focus) are biased towards initial project implementation (such as land preparation and seed or sapling planting) at the expense of later management effort over subsequent decades. The result may be ecosystem failure requiring re-work and a substantial new injection of funds. According to the UN Food and Agriculture Organization (FAO) this problem is widespread around the world – plantation initiatives have often been “promotional events” with inadequate action taken to fully implement an initiative and/or to foster continued tree growth¹⁸.

Moreover, such failed outcomes may carry an additional ecological cost alongside the economic cost – namely lost native seed supply. Native seeds around the world are in high demand, and supply is limited due both to the challenging nature of collection and to the decline in healthy native ecosystems from where these seeds are harvested.

Responding to Risk

Whilst there are multiple risks to permanence, there are also potential ways to address them, relevant either to the carbon markets specifically, or to ecosystem preservation and restoration more generally.

In the compliance carbon market, project and activity standards and methodologies are regulated through international, regional and sub-national schemes, such as the Clean Development Mechanism (CDM) under the Kyoto Protocol, the European Union Emissions Trading Scheme (EU-ETS) and the California Carbon Market. In the (soon to be replaced) CDM for example, a principle of “conservativeness” was applied in order to avoid over-estimation of emissions mitigation. This, at least in theory, required stringent monitoring, reporting and verification (MRV)¹⁹. The issue of permanence in afforestation and reforestation projects was addressed by treating all forestry credits as temporary with certified emissions reductions designated as either long-term or short-term²⁰.

Under Article 6 of the Paris Agreement the CDM is being phased out and replaced by the Sustainable Development Mechanism (SDM). Currently, exact details are still being worked out on how projects will be assessed for qualification and how emissions mitigation will be measured and monitored²¹. Still, the Article 6 rules do state that SDM activities must minimise and fully address any risks of “non-permanence”, and this includes rectifying any reversals²². Projects and mitigation activities will be initially validated by an independent, accredited auditor known as a Designated Operational Entity (DOE). The DOE will also verify and certify mitigations during a project’s operational life. Concerns about permanence may be addressed both by some form of insurance guarantee and also by a buffer (more on this below). Some market commentators have observed that such provisions will be aided by advances in carbon monitoring technology and real-time data tracking of carbon emissions and retention²³.

In the voluntary carbon market (VCM), for a carbon project (and hence its credits) to be judged as high-quality, it must be assessed by, and adhere to the standards of, a leading certification agency. There are two major standards: the Gold Standard (GS) and the Verified Carbon Standard (VCS). VCS focuses on forest conservation projects and on reforestation, afforestation, and renewable energy projects. Gold Standard focuses more on social development projects such as clean cookstoves, clean drinking water, agroforestry, and also on reforestation, and renewable energy²⁴. During both project development and implementation, there are various stages that require validation. These should combine rigorous scientific methodologies, peer review, accurate monitoring/surveillance and regular verification to meet the internationally recognized standards of e.g. the GS or VCS and ensure project integrity.

Furthermore, when projects have a permanence/reversibility risk as forestry does, it is common practice for standards bodies to include carbon credit buffer provisions. Such provisions require that a project sets aside a percentage of the credits generated into a buffer pool which acts as an insurance mechanism²⁵. The number of credits a project must contribute to the buffer reserve is usually based on an assessment of the project’s risk for reversals. If a reversal occurs – due, say, to a forest fire – then credits are retired or cancelled from the buffer reserve²⁶.

That said, the use of buffer pools has its critics. According to some, the way buffer pools are calculated is out of date and hasn’t been calibrated to a swiftly changing climate. Climate change, critics argue, is creating more damaging wildfires and destroying more credit-protected forestry carbon sinks. Therefore buffer credits may be insufficient to account for increased losses as climate change becomes more impactful²⁷.

Meanwhile, others say that buffers represent a moral hazard if they’re used to compensate for human-caused reversals. If, for example, a project faces no penalty for harvesting trees – because the reversal would be compensated out of a buffer reserve – then the landowner could have a strong incentive to harvest. Solutions to this problem include buffers that only compensate for natural and not human causes; and not issuing further credits for a project until the reversal is remedied²⁸.

Manage, Measure and Monitor for Success

In any case, the buffer system implicitly points to the most important aspect of addressing permanence and reversibility. As noted earlier, good project design and management is crucial, and this tends to affect the level of the buffer. Developers are therefore encouraged to design projects for longer time horizons and adopt strong risk mitigation strategies since long-term projects with a low-risk profile will be subject to a lower buffer withholding requirement²⁹. And, of course, these projects will generate better quality carbon credits that are likely to command higher prices. Such risk mitigation strategies may cover:

- physical measures like forest thinning or other approaches to reduce the risks of fire and disease;

- financial management practices to reduce the risk of project failure or bankruptcy;

- legal restrictions or non-possessory ‘easement’ rights over land owned by another (e.g. to protect against logging) and other measures to guard against over-harvesting or land conversion³⁰.

These strategies require good management and adequate funding to ensure ‘permanence’ in ecosystem preservation and restoration. And that means that return-on-investment calculations mustn’t just focus on current and future biomass yield and carbon storage potential. They must also factor in realistic costs and requirements of ongoing management over the long term.

Effective management requires reliable information and actionable insights for risk mitigation. Put another way, high-quality carbon credits gain value from good data and analysis to ensure they reflect a project’s performance as intended. Ideally, this may include satellite data, climate models and land management techniques in order to monitor and verify a project’s permanence (among other characteristics)³¹. Dendra can enhance this process by leveraging its innovative expertise in high-resolution image capture and AI-powered analytics. Robust verification and monitoring may be more costly in the short run, but it can significantly improve biomass survival and sequestration rates, and helps detect and address ecosystem risks much more effectively³².

References

- Moore (2008): https://blogs.edf.org/climate411/2008/02/26/ghg_lifetimes/

- Moore (2008) and Buis (2019): https://climate.nasa.gov/news/2915/the-atmosphere-getting-a-handle-on-carbon-dioxide/

- https://www.offsetguide.org/high-quality-offsets/permanence/

- UNFCCC (2021): https://unfccc.int/sites/default/files/resource/cma2021_L19E.pdf

- Carbon Market Watch (2020): Carbon Markets 101 https://carbonmarketwatch.org/wp-content/uploads/2020/07/CMW-ENGLISH-CARBON-MARKETS-101-THE-ULTIMATE-GUIDE-TO-MARKET-BASED-CLIMATE-MECHANISMS-FINAL-2020-WEB.pdf

- Austin et al (2020): https://www.nature.com/articles/s41467-020-19578-z

- https://www.theguardian.com/environment/2019/jul/04/planting-billions-trees-best-tackle-climate-crisis-scientists-canopy-emissions

- Klein (2020): https://www.greenbiz.com/article/quest-carbon-offsets-almost-anything-goes

- https://www.theguardian.com/environment/2019/jul/04/planting-billions-trees-best-tackle-climate-crisis-scientists-canopy-emissions

- Pörtner et al (2021): https://zenodo.org/record/5031995#.YO50Ki2cZPs,%20https:%2F%2Fipbes.net%2Fsites%2Fdefault%2Ffiles%2F2021-06%2F20210609_workshop_report_embargo_3pm_CEST_10_june_0.pdf and Blaufelder et al (2020): https://www.mckinsey.com/business-functions/sustainability/our-insights/how-the-voluntary-carbon-market-can-help-address-climate-change

- Burgelman (2022): https://blog.frontiersin.org/2022/03/15/new-high-resolution-map-shows-fires-caused-one-third-of-global-forest-loss-between-2001-and-2019/

- https://futureearth.org/publications/issue-briefs-2/global-fires/

- https://futureearth.org/publications/issue-briefs-2/global-fires/

- https://futureearth.org/publications/issue-briefs-2/global-fires/

- https://cdn.odi.org/media/documents/6086.pdf

- https://www.tma.earth/2021/05/24/how-much-does-it-cost-to-plant-a-tree-and-why-that-may-not-be-the-right-question/

- https://www.tma.earth/2021/05/24/how-much-does-it-cost-to-plant-a-tree-and-why-that-may-not-be-the-right-question/

- https://www.bbc.co.uk/news/science-environment-61300708

- https://wedocs.unep.org/bitstream/handle/20.500.11822/39975/Article6_CDM.pdf?sequence=3&isAllowed=y

- https://www.climate-policy-watcher.org/kyoto-protocol/how-the-issue-of-permanence-is-dealt-with-in-different-schemes.html

- https://carbonmarketwatch.org/2021/12/10/faq-deciphering-article-6-of-the-paris-agreement/

- https://my.slaughterandmay.com/insights/client-publications/global-carbon-markets-after-cop26-the-past-present-and-future

- https://www.iisd.org/articles/paris-agreement-article-6-rules

- Piel and Knöpfle (2022): https://www.climatepartner.com/en/news/what-makes-a-high-quality-carbon-offset-project

- Blaufelder et al (2020): https://www.mckinsey.com/business-functions/sustainability/our-insights/how-the-voluntary-carbon-market-can-help-address-climate-change

- https://www.offsetguide.org/high-quality-offsets/permanence/how-carbon-offset-programs-address-permanence/

- Klein (2020): https://www.greenbiz.com/article/quest-carbon-offsets-almost-anything-goes

- https://www.offsetguide.org/high-quality-offsets/permanence/how-carbon-offset-programs-address-permanence/

- Kollmüss (2008): https://www.globalcarbonproject.org/global/pdf/WWF_2008_A%20comparison%20of%20C%20offset%20Standards.pdf

- https://www.offsetguide.org/avoiding-low-quality-offsets/conducting-offset-quality-due-diligence/permanence/

- Klein (2020): https://www.greenbiz.com/article/quest-carbon-offsets-almost-anything-goes

- https://treesisters.org/blog/much-cost-plant-tree